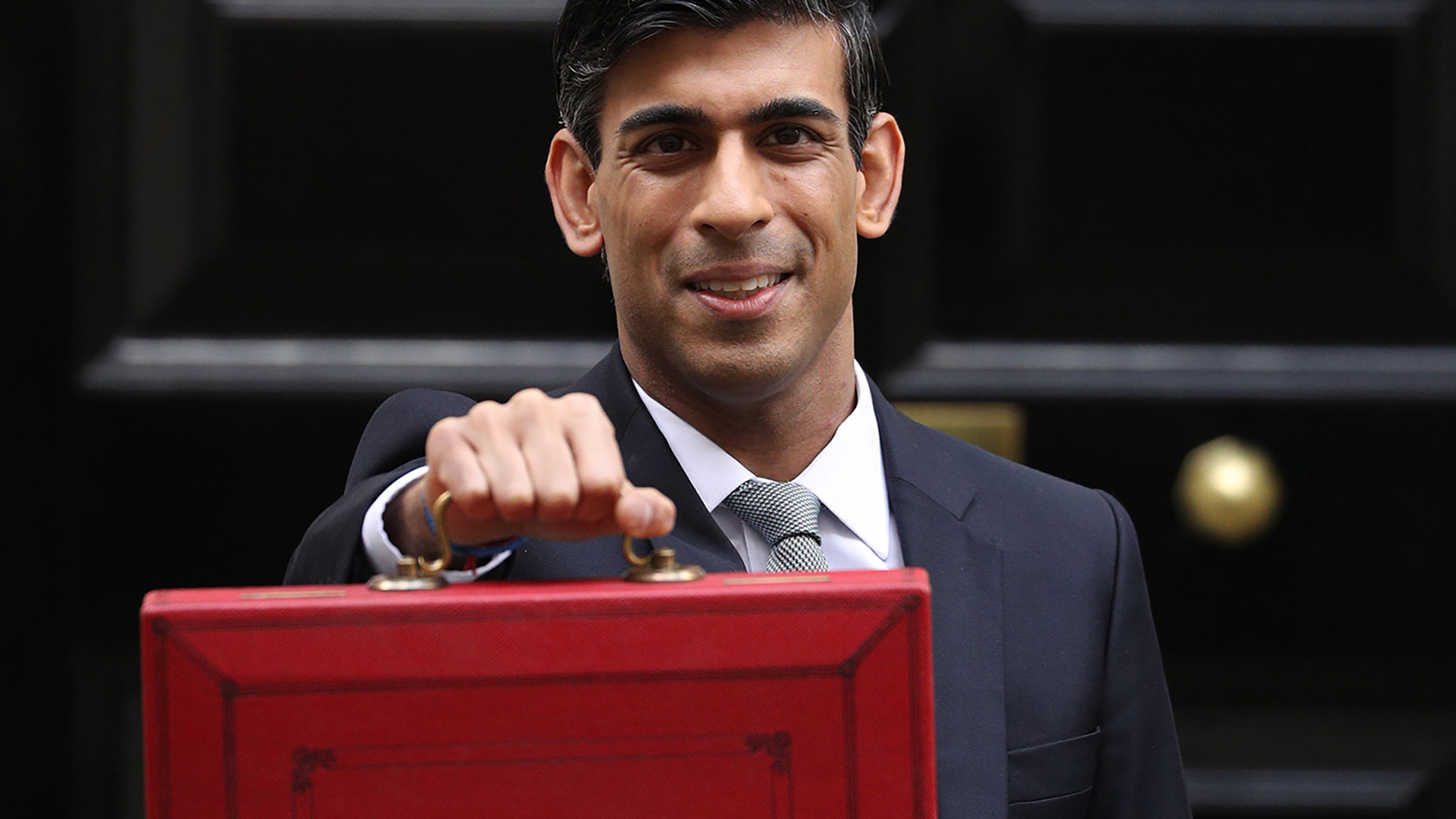

The Chancellor has been captured on video expressing his love of Coca Cola. The drink is fine when fizzy, not so much when flat.

A FIZZING ECONOMY.

The fizzy scenario following his budget will see the UK emerge from the pandemic at the same time as the support measures for business and universal credit fall away. There will be a huge 7% bounce back in growth and people will feel confident enough to return to work and our town centres. Above all interest rates will remain very low. In those circumstances Rishi Sunak will be well positioned to be our next Prime Minister.

The promotion of the Chancellor was on a grand scale with lots of media appearances, photo opportunities and massive leaking of the budget proposals. We are a long way from Chancellor Dalton’s resignation in 1947 when one indiscreet comment to a journalist cost him his job. Rishi is on manoeuvers. Boris Johnson looked a rather diminished figure slumped on the frontbench with his mask on while suited and booted Rishi delivered his budget. The rivalry is likely to grow between the two men in the coming years, particularly when the crushing burden of the pandemic eases and Sunak can pose as a traditional low tax Tory compared to Johnson who wants to spend more on public projects.

A FLAT ECONOMY.

However, Sunak’s ambitions could be completely derailed by setbacks in the emergence from the pandemic. Some are wondering why the support measures have been extended into the autumn, well beyond the planned end of restrictions in June. Could it be a cover for extensions to the current curbs on daily life?

Another big worry for the Chancellor would be a rise in interest rates and the consequent massive problems of servicing the debt.

Finally, there is the issue of how business will respond in the post pandemic world. The UK has the additional worry of the negative effects of Brexit.

THE BUDGET CONTENTS

All these factors contributed to an interesting Budget where continued support for firms and people was combined with a major reversal of policy on Corporation Tax. The EU need no longer fear a freewheeling Singapore style UK. Big business will be paying for the lockdown and the country will have the highest tax burden since 1969.

The Chancellor has sought to reward the North for breaking down the Red Wall. Freeports are to be created in Liverpool, Hull, and Teesside. A Treasury campus is to be set up in Darlington and a Green Investment Bank in Leeds. A billion pounds is to be invested in towns including Southport, Cheadle, and Preston.

STARMER’S MISSED OPPORTUNITY.

With the Tories spending billions on state intervention on the grand scale, Labour has a fiendishly difficult task on its hands in showing why it’s worth voting for.

However, a huge opportunity has been missed by Kier Starmer both in his major speech recently and in his Budget response. Why hasn’t Labour filled the gaping hole in Sunak’s announcements, that being social care?

Labour could differentiate itself from the timid Tories who keep promising to do something about this issue and failing to do so. Starmer could promise a scheme to end the lottery and hardship of the current system and challenge Boris Johnson to support it.